Amazon to begin collecting 17.5 per cent VAT from Barbadian customers.

After several false starts, the Mia-Mottley administration appears to have made a major breakthrough in a controversial bid to collect Value Added Tax (VAT) on online purchases from some major retailers.

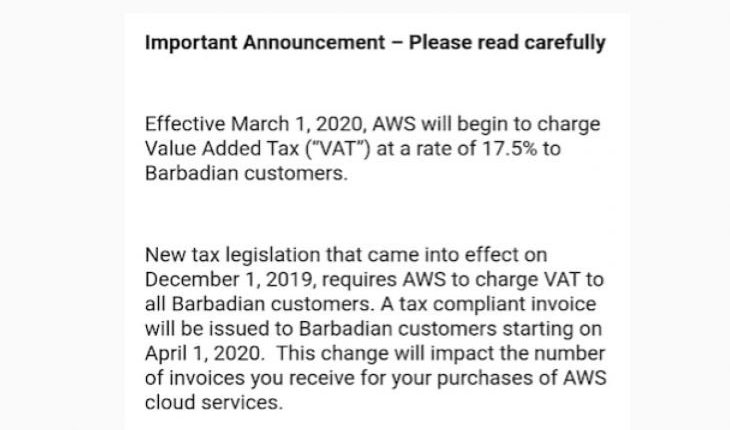

The “Amazon” tax as it has become known, is to be implemented next month according to multinational e-commerce giant, Amazon. The company on Monday informed customers that effective March 1, 2020, “Amazon World Service (AWS) would begin to charge Value Added Tax at a rate of 17.5% to Barbadian customers.

The Seattle-based company detailed its intention in an email correspondence titled “Important Announcement” in which it noted that the new measures are consistent with tax legislation which came into effect on December 1, 2019. The company said that a tax compliant invoice would be issued to Barbadian customers from April 1 this year.

The email was reportedly sent to all customers whose records indicate that their Billing Address or Contact Address is in Barbados. It explained to customers that the website calculates taxes based on the customer location, which is determined by Amazon’s Account Location hierarchy.

To ensure compliance, Amazon has urged Barbadian residents whose accounts are not listed in Barbados, to update their details by visiting the Billing Address and Contact Address page of the AWS Billing Console.

“Tax invoices will appear in the Bills page of the AWS Billing Console along with your anniversary and subscription summary invoices starting on April 1, 2020,” the email further explained.

“If you receive your anniversary or subscription invoices via email today, you will also receive tax invoices via email starting on April 1, 2020,” it added.

Barbados TODAY’s efforts to reach Minister in the Ministry of Finance and Economic Affairs Ryan Straughn for a comment on the developments were unsuccessful.

The measure known as the “Amazon tax”, announced during Prime Minister Mia Mottley’s June 2018 budget was initially to begin in October of that year but was shifted two months later to December 1 and then to December 15th.

The following year, legislation was introduced to allow the Barbados Revenue Authority (BRA) to outsource tax-collecting powers to an online third-party and the measure was to be introduced by July 1. This also was unsuccessful.

When first introduced, numerous businessmen including former Chamber of Commerce and Industry (BCCI) President, Eddy Abed praised the move for placing local retailers and wholesalers on a level playing field with their overseas counterparts. Smaller businesses, however, complained that the measures could cripple their chances of survival by significantly increasing their costs.

Nevertheless, changes were made to the Value Added Tax Act last December adding further scrutiny to the VAT collection process.

Shortly after, current BCCI president Trisha Tannis expressed concern about compliance from popular international online companies like Amazon, Wal-Mart, Alibaba.

Amazon’s expression of an intent to comply therefore suggests a major breakthrough in the Government’s efforts to implement the tax. It is still unclear if other international retailers will follow suit.