ECCB Outlines Strategies to Save Banks

(ZIZ News) – The Eastern Caribbean Central Bank [ECCB] has outlined the strategies it will implement to enact the new powers granted by the recently passed Banking Act 2015.

In Tuesday’s sitting of the National Assembly, Prime Minister the Hon. Dr. Timothy Harris noted that the new act would give the ECCB the power to intervene and save banks that were suffering due to economic circumstances.

On Wednesday evening, ECCB officials hosted a teleconference to update media persons from around the region on the details of their strategy to stabilize the banking system.

According to a statement, the strategy is made up of two components: a pre-emptive approach which addresses immediate threats and a long term structural revamp to prevent future threats to financial safety.

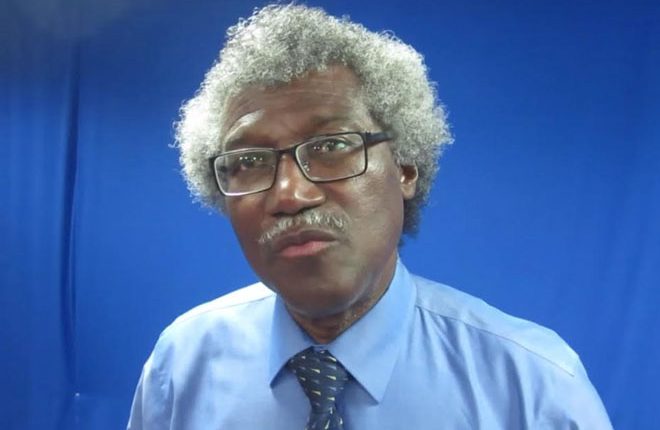

Governor of the ECCB, Sir K. Dwight Venner told ZIZ News that as economies get worse, banks suffer and the ECCB would need to step in and provide solutions.

He added, “The World Economy, you know, is not growing as fast as it should, and we are very vulnerable. That’s what characterizes us. So what we have to do is we really have to build in some resilience to the whole process so if these things come, you have enough capital. And that’s the issue.”

Sir Dwight also spoke about whether any banks in St. Kitts and Nevis may need an intervention by the ECCB.

“At the moment, no. We’ve done some diagnostic tests going over all the banks who are not in an intervention to see where they are. And so while some of them are borderline-ish we would like to work with them to see if we can get them to a stage where they get out of the firing line, so to speak,” he explained.

During Wednesday night’s press briefing, Sir Dwight answered questions from the ECCU member countries covering topics including constitutional rights, the new powers granted by the Banking Act, and Citizenship by Investment Programs.